My wife is a nurse. Every evening, she tells me stories about her patients.

One day, she told me about a patient who quit taking her insulin. She was recently diagnosed with diabetes, and decided she didn’t have time for insulin shots. They were painful. They took time out of her day. For her, the present inconvenience of following the doctor’s orders wasn’t worth whatever pain it might prevent in the future.

Her health quickly deteriorated. She returned to the hospital one month later—this time to the emergency room. Because of her uncontrolled diabetes, a small sore on her leg had developed into a serious bone infection. She would never walk again.

Unfortunately, stories like this are common at hospitals. The sickest people are often those who ignore their doctor’s advice; yet hospitals exist, of course, to serve the sickest people. Because of this, doctors and nurses expect to see many patients admitted for preventable illness—it comes with the job.

Medical professionals are not the only ones that deal with such behavior, however. I recently spoke to a financial advisor who recounted similar stories about some of his clients. One couple in particular ignored his advice and took a 401(k) loan to buy a second home. They’d seen a family friend double his investment in just six years and were convinced they would do the same. That was in 2007.

I’ve heard economists discuss similar frustrations with policymakers in Washington. While extending new credit and driving interest rates down might stave off recession in the short term, such policies are not sustainable in the long term. Nevertheless, the Federal Reserve continues to use new money to stimulate demand. They’ve guaranteed low interest rates for months and even years to come, enticing investment into risky projects that remain untested outside of our inflationary economic environment.

Another obvious parallel are the spending habits of the average American. Half of all Americans have less than three months’ worth of emergency savings and one in three is not saving for retirement. Of course, not everyone enjoys a steady job and enough income to make ends meet. But more than half do. That being said, such decisions are anything but conducive to a secure financial future. They defy the most basic of instructions about wise financial planning, and I doubt any of the culprits would honestly disagree.

[pullquote] Remember that though it may always be uncertain, the future is worth preparing for.[/pullquote]

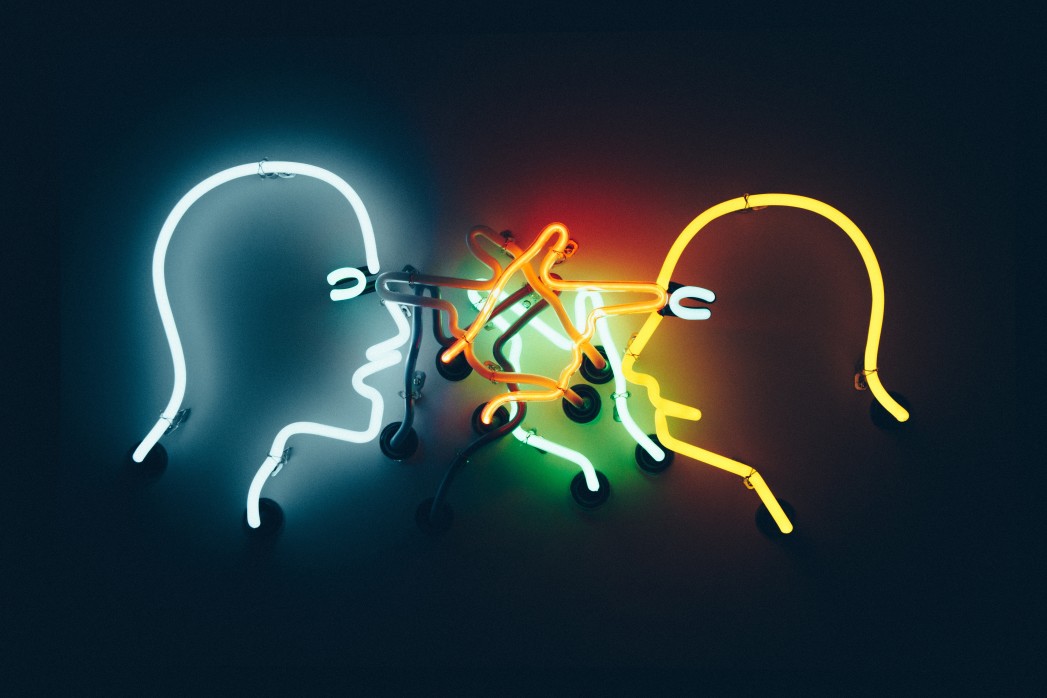

Like my wife’s patient, the behavior I describe above indicates a general disregard for future wellness in favor of present satisfaction. Economists call this a “high time preference.” Instead of investing in long-term projects that yield generous and lasting returns, many of us prefer instead to spend in the present. We value today more than tomorrow. We live as if the future holds only blessings.

I’ve seen the negative effects of high time preference in my own life, with regard to both my health and personal finance. I’m sure you have, too. Like the woman in the story above, the effects are painful—and sometimes permanent. They might arrive via phone call from a debt collector or via notice from your landlord. They may surface on your report card or on your bathroom scale. If enough of us give in, they can even show up in the form of economic recession, when we realize there just isn’t enough money to go around.

But how they arrive is not important. What matters is that they always will.

So take time at the beginning of this year to reflect on your thinking with regard to the future, the present and how you use what you’ve been given. Make 2014 your year of growth—not catch up and squeak by. Remember that though it may always be uncertain, the future is worth preparing for.